A possible start of a bearish trend on GOLD

GOLD has broken through a support line of a Cunha ascendente chart pattern. If this breakout holds true, we may see the price of GOLD testing 1932.3674 within the next 6 hours. But don’t be so quick to trade, it has tested this line in the past, so you should confirm the breakout before taking […]

Will SILVER have enough momentum to break resistance?

SILVER is heading towards the resistance line of a Triângulo and could reach this point within the next 2 days. It has tested this line numerous times in the past, and this time could be no different from the past, ending in a rebound instead of a breakout. If the breakout doesn’t happen, we could […]

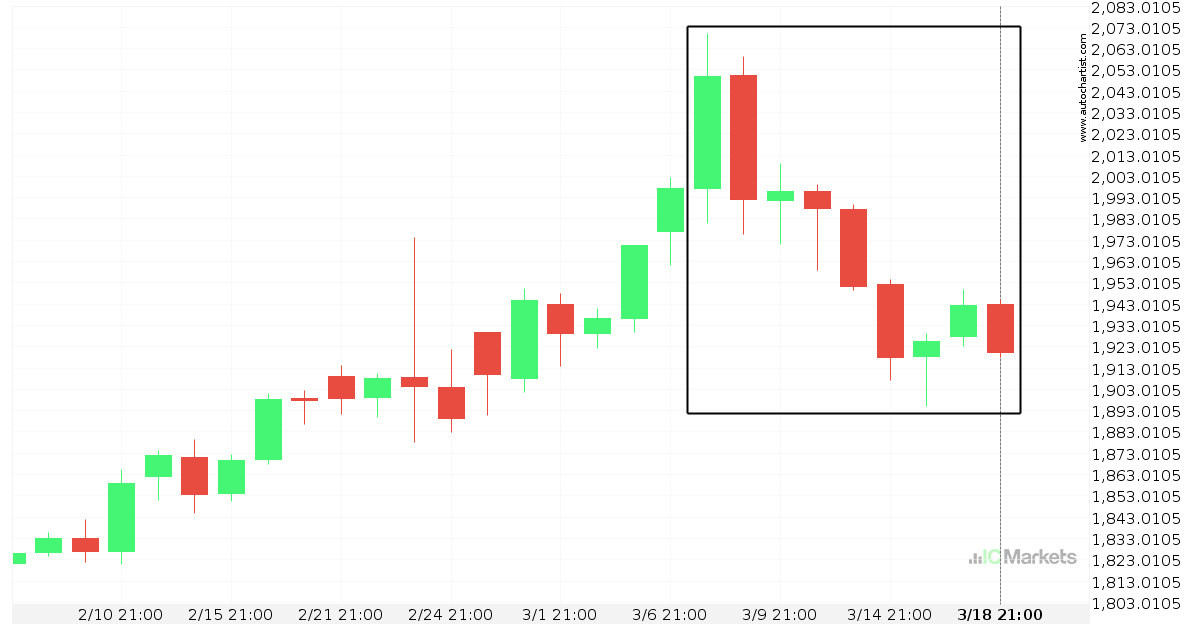

Huge bearish move on GOLD

GOLD has moved lower by 6,33% from 1.996,63 to 1.919,98 in the last 12 days.

Will SILVER have enough momentum to break support?

SILVER is heading towards the support line of a Canal descendente and could reach this point within the next 2 days. It has tested this line numerous times in the past, and this time could be no different from the past, ending in a rebound instead of a breakout. If the breakout doesn’t happen, we […]

GOLD approaching support of a Canal descendente

GOLD is approaching the support line of a Canal descendente. It has touched this line numerous times in the last 9 days. If it tests this line again, it should do so in the next 3 days.

Should we expect a bullish trend on SILVER?

The breakout of SILVER through the resistance line of a Canal descendente could be a sign of the road ahead. If this breakout persists, we may see the price of SILVER testing 25.5814 within the next 2 days.

GOLD – getting close to resistance of a Canal descendente

GOLD is moving towards a resistance line. Because we have seen it retrace from this line before, we could see either a break through this line, or a rebound back to current levels. It has touched this line numerous times in the last 8 days and may test it again within the next 2 days.

SILVER approaching support of a Canal descendente

SILVER is approaching the support line of a Canal descendente. It has touched this line numerous times in the last 5 days. If it tests this line again, it should do so in the next 17 hours.

GOLD – getting close to support of a Canal descendente

GOLD is moving towards a support line. Because we have seen it retrace from this line before, we could see either a break through this line, or a rebound back to current levels. It has touched this line numerous times in the last 21 hours and may test it again within the next 6 hours.

Should we expect a breakout or a rebound on GOLD?

The movement of GOLD towards 1970.1000 price line is yet another test of the line it reached numerous times in the past. We could expect this test to happen in the next 12 hours, but it is uncertain whether it will result in a breakout through this line, or simply rebound back to current lines.